HHS Global Issues Class Explores the Microfinance Market

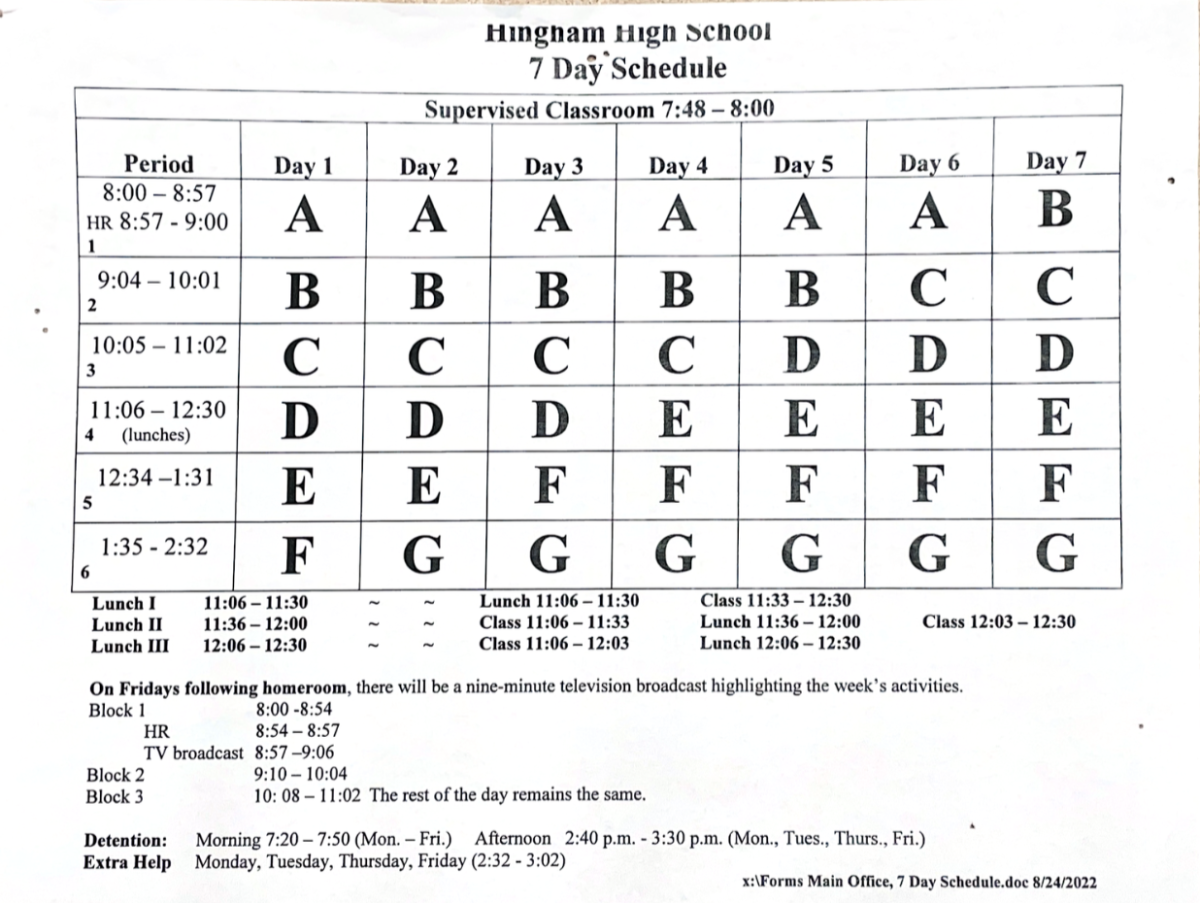

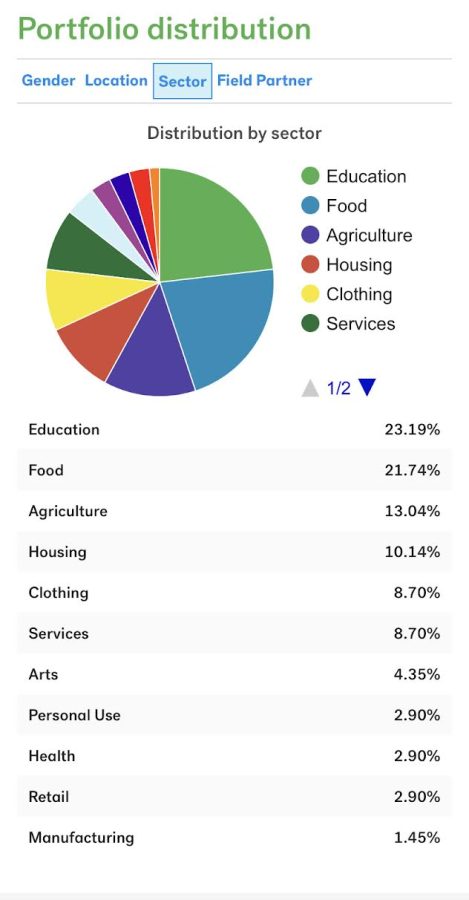

Kiva keeps track of the sector distribution of borrowers. This data is specific to lenders.

March 15, 2022

At Hingham High School, providing students with the skills, knowledge, and tools to better the world outside of the classroom remains a priority. In her Global Issues course, Ms. Kara Roth focuses on connecting the curriculum to the real world through a microfinancing unit.

The modern use of the term “microfinancing” dates back to the 1970s and 1980s when Bangladeshi economist Dr. Mohammad Yunus began experimenting with the concept of credit in lower-income communities. Unlike conventional banking companies and most economic theorists, Yunus believed that impoverished people without any credit history or assets would be just as likely as wealthier people with banking resources to honor loans if given the opportunity to do so. By establishing the Grameen Bank in Jobra, Yunus started providing small yet extremely impactful loans and initiated the modern microfinancing movement that continues to empower entrepreneurs today.

In her Global Issues class, after reading Nicholas Kristof and Sheryl WuDunn’s Half the Sky: Turning Oppression into Opportunity For Women, Roth always follows with a microfinance project using the online nonprofit Kiva. Using their website which reports a 96% borrower repayment rate, Roth and her students research and select entrepreneurs to loan to. Roth began the class fund a couple of years ago, and each semester, the fund increases as more students choose to add money. While she never requires students to donate, she has witnessed much generosity. She also matches their donations up to $25.

Roth explained, “Every semester, I enjoy ending the Global Issues course with a real-life application of investing in real-life entrepreneurs around the globe. After studying about a lot of seemingly intractable problems, it’s nice to empower students with even a small amount of resources to create positive change for individuals.”

In the fall of 2021, the class fund began with $200, all accumulated from donations from Roth and her former students. What she had not expected, however, was to add $300 to that fund due to the extremely engaged and thoughtful students in her Semester 1 class.

Roth shared, “I was particularly impressed with the level of enthusiasm, maturity, and generosity of this class with this microfinance activity.”

The class has lent to people from Uganda, Palestine, Vanuatu, Vietnam, Indonesia, and more. 76% are women. Some of these borrowers seek loans to fix family toilets, while others hope to use the money to kickstart their local businesses or purchase a piece of land. After using the money, the borrowers consistently prove worthy of credit and gradually pay back their loans to the fund that Roth reuses with her next group of students. The Global Issues class fund has a default rate of only 1.7%. Kiva also updates Roth when borrowers repay portions of their loans. In February, the Global Issues account received $24.37 in the form of repayments from eight different entrepreneurs.

While Kiva allows for larger investments, Roth’s class tends to loan amounts less than $100. The amount may seem insignificant, but Boer confirmed otherwise: “A [small] loan towards agriculture in Uganda could aid in bolstering the nation’s self-sustainability.”

Kanter added, “I thought it was a really cool experience to see how big of an impact we could make even as just a small group. It was also nice to do something in school that had a direct positive impact on the world.'”

Projects like this one verify how Hingham High students and faculty remain dedicated and determined to use what they learn in the classroom to help others outside of it as much as they can.