As the artificial intelligence boom continues to sway markets in favor of technology companies, investors are now looking to capitalize on resources needed for manufacturing. Even high schoolers have looked into investing in AI resources. Senior Charlie Peak says, “I’m probably going to invest in lithium companies because of batteries and EVs.” Like Charlie, firms have already jumped on the major players of copper, rare earth elements, gold, and silver; however, as companies begin developing more advanced manufacturing materials, these staples become less necessary by the day.

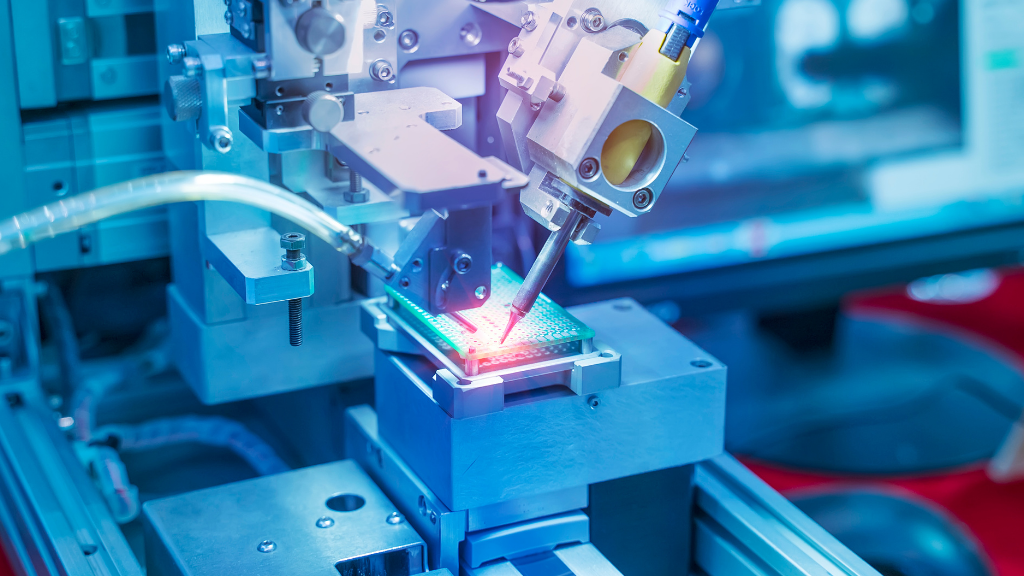

One such material that has recently gained attention is 2D materials. These materials are often only an atom-thin, but they carry extraordinary properties that have proved to be beneficial to numerous manufacturing industries. Perhaps the most prominent of these materials is Graphene: a thin carbon material that is 200 times stronger than steel and can conduct electricity better than most current metals on the market. Graphene also thrives under hot temperatures, making heat management one of its most beneficial qualities, which is crucial for chip manufacturing. While its involvement in commercial settings has remained limited since its creation by physicists in 2004, Graphene boasts major potential implications 5-10 years into the future. Due to its limited current usage by major Taiwanese manufacturers, Graphene stocks are heavily undervalued. Major players, including NanoXplore and Directa Plus, both experienced highs in July and have since dipped down to prime values. NanoXplore (NNXPF) trades on the Pink Sheets currently at $1.58, and Directa Plus (DCTA) trades on the London Stock Exchange at $7.00. Both hit highs of $2.36 and $20.40, respectively, this summer. While these stocks remain risky due to Graphene’s volatile future, if investors are willing to patiently hold both companies for 10-20 years, then they could be in for a monumental payday.

Some worry about a possible AI bubble, though. Hingham High graduate (Class of 2023) Sam Peacock says, “I’m getting worried about all of the AI stocks… most of them are just way overvalued.” However, Graphene isn’t just used for AI production; its role is expanding in both civilian and defense sectors. Graphene has been used to aid aviation production and to improve batteries. Looking into the future, as manufacturing facilities begin advancing their materials to produce improved products due to a highly competitive market, Graphene stocks will skyrocket while other commodities will be left behind.