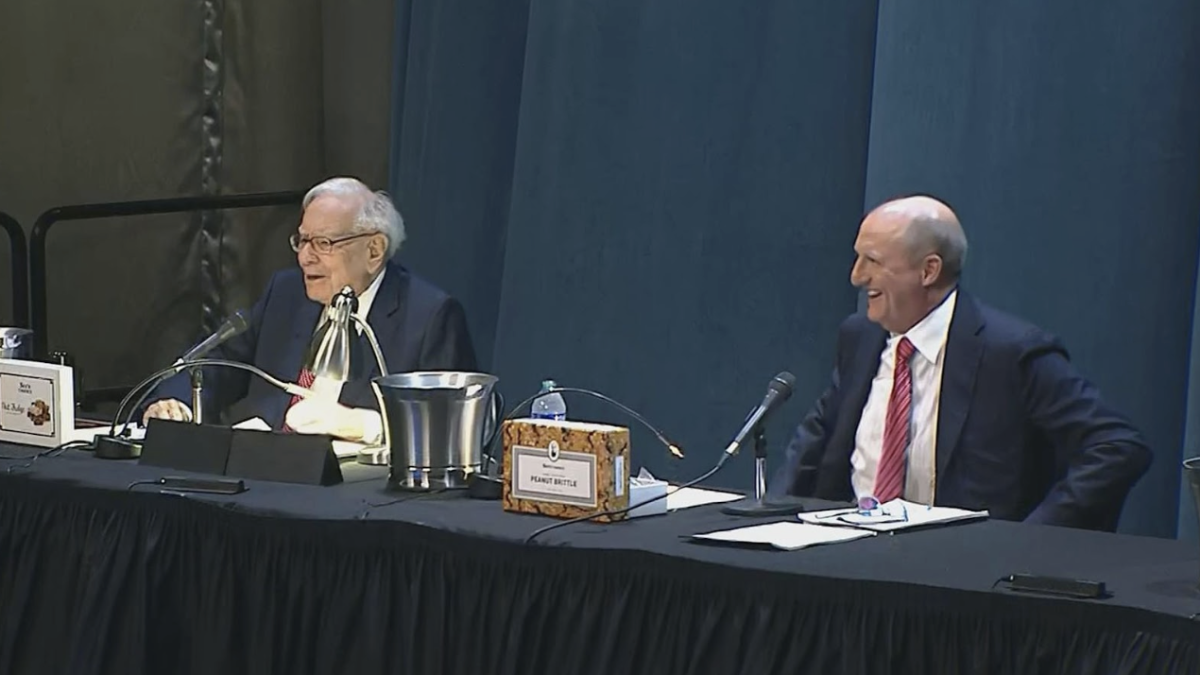

After 60 years of leading Berkshire Hathaway, Warren Buffett officially stepped down as CEO on Thursday, January 1, 2026, passing his role to his carefully selected successor, Greg Abel. Buffett, 95, transformed Berkshire Hathaway from a struggling textile manufacturer into one of the world’s most successful corporations, and his departure marks the end of an era for both the company and the business world.

Greg Abel, 63, officially became CEO on Friday. He has worked at Berkshire Hathaway since 2000, most recently serving as Vice Chairman and overseeing the company’s non-insurance operations. Abel is known for his hands-on approach while maintaining the decentralized structure that has been a hallmark of Berkshire under Buffett. Despite the transition, Buffett will remain chairman and continue to come into the office five days a week, offering Abel mentorship and guidance. In the first trading day after the transition, Berkshire Hathaway’s Class A shares fell 1.5%. While this minor drop surprised some investors, analysts say it reflects the challenges of transitioning leadership after such a long tenure rather than concerns about Abel’s abilities. Buffett has expressed confidence in Abel repeatedly, calling him the “decider ” and saying, “I’d rather have Greg handling my money than any of the top investment advisors or any of the top CEOs in the United States.”

Members of the HHS community have shared their thoughts on the leadership change. Junior Ryan Kennedy shared, “It’s surprising to see Buffett step down after so many years. I’m curious to see how Greg Abel will lead the company and whether he’ll make big changes.”

HHS business teacher, Mr. Tarantello, added a detailed perspective, saying, “Mr.Buffet is revered as one of, if not the best, investors of all time. It will certainly be a new era for Berkshire Hathaway. In what is often a complex and fast-paced investing world, I have always appreciated Mr.Buffett’s advice, especially his emphasis on investing in affordable funds that track the stock market and his strong belief in American Industry.”

Similarly, Sadie Sheehan shared a similar perspective, “Knowing how long Warren Buffett has been the head of Berkshire Hathaway, it seems strange for it to be run by someone new. It makes me think about how hard it will be for Abel to fill such big shoes.”

Buffett’s last letter to shareholders highlights his philosophy on leadership, money, and kindness, emphasizing that greatness comes from helping others, not accumulating wealth or power. Many experts believe Abel will continue Buffett’s approach, focusing on steady growth while respecting the company’s decentralized culture. Abel has already made some leadership adjustments, including a management appointment, and analysts expect him to gradually face decisions about dividends and acquisitions.

Overall, the transition at Berkshire Hathaway is historic, both for the company and the business world. As Abel begins his tenure as CEO, all eyes are focused on how he will guide the trillion-dollar conglomerate into the future. HHS students seem interested in the changes and are curious to see how one of the world’s most famous companies will evolve under new leadership.